Executive Summary

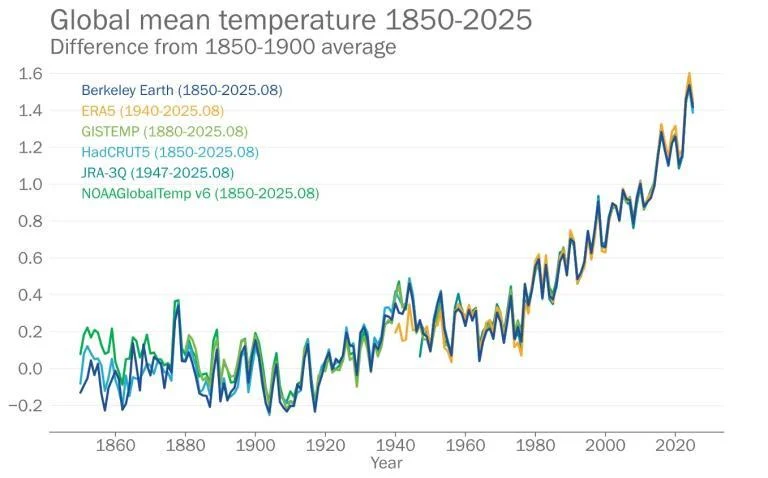

2025 is on track to be the second or third warmest year ever recorded, with the mean near-surface global temperatures about 1.42°C above the pre‑industrial average and greenhouse gas concentrations at record highs. Extreme heat, floods and wildfires have generated significant human and economic losses in 2025, reinforcing our understanding and belief that climate risk is now a core macro‑ and financial variable rather than a distant externality.

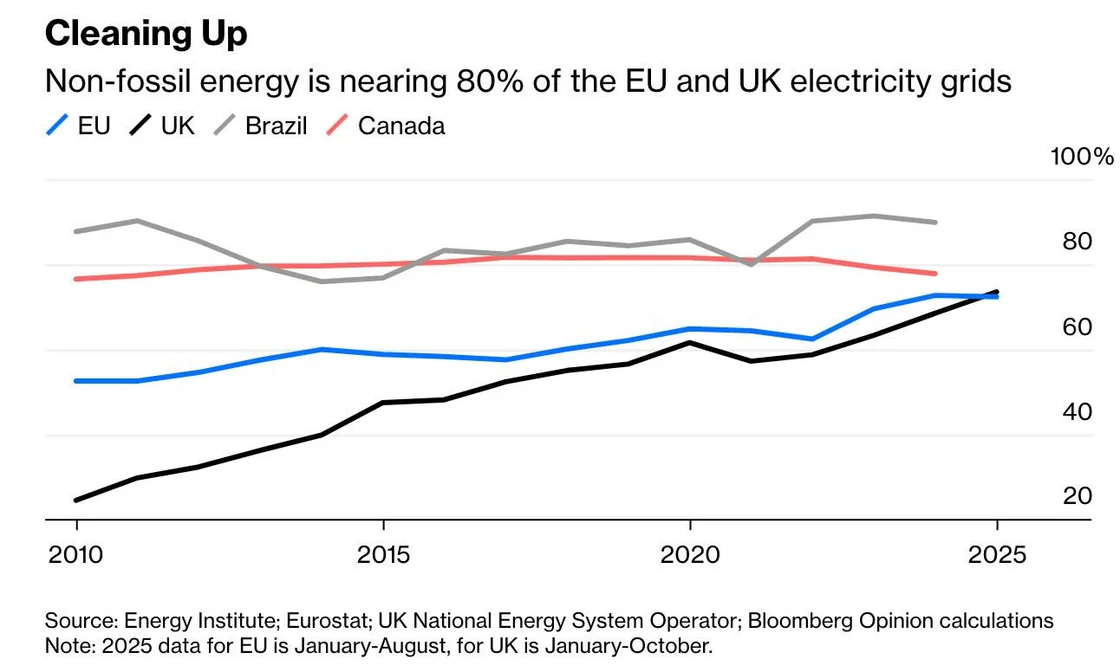

At the same time, capital deployment into the energy transition has reached new records, and some major power systems are now sourcing roughly three‑quarters of their electricity from non‑fossil sources. Electric vehicles have moved from niche to mainstream in key markets, and policy efforts at COP30 in Belém have promised a step‑change in commitment on climate finance, even as debates over fossil fuel phase‑out and industrial policy remain contentious. The result is a world of rising physical climate risk, but also of accelerating technological progress and deepening integration of climate considerations into economic policy, corporate strategy and capital markets.

A hotter, more volatile climate

The World Meteorological Organisation (WMO) projects that 2015–2025 will be the eleven warmest years in the 176‑year instrumental record, with 2025 likely to rank second or third. The mean near‑surface temperature from January to August 2025 was approximately 1.42°C above the pre‑industrial baseline, only slightly below the record levels of 2024 as El Niño faded.

WMO highlights continued retreat of Arctic and Antarctic sea ice, record‑high ocean heat content and an almost doubled rate of sea‑level rise compared with the 1990s, driven by both ocean warming and ice‑mass loss. These physical indicators translate directly into higher probabilities of extreme events: in 2025, climate‑ and weather‑related disasters from floods, heatwaves, wildfires and tropical cyclones caused “massive social and economic disruption,” with knock‑on effects on food systems, infrastructure and sovereign balance sheets.

Policy shifts

Climate policy in 2025 has been marked by both retrenchment and renewed ambition. In several advanced economies, most notably the United States, policymakers have moved to curtail or roll back elements of earlier climate frameworks, such as tax credits for clean energy and electric vehicles, offshore wind development and regulatory tools under the Clean Air Act. These shifts create near‑term uncertainty for project pipelines, but they also force a more explicit balancing of affordability, energy security and decarbonisation in national debates.

As discussed in last month’s report, at COP30 in Belém, Brazil, delivered one of the most significant outcomes on climate finance since the Paris Agreement, even as it stopped short of a clear collective commitment to phase out fossil fuels. Parties agreed to mobilise at least 1.3 trillion US dollars per year in climate finance by 2035, with a tripling of adaptation finance and the operationalisation of the loss‑and‑damage fund first agreed at COP28. The conference also launched the “Global Implementation Accelerator” and the “Belém Mission to 1.5°C,” aimed at helping countries turn climate pledges into concrete mitigation and adaptation plans.

Science, data and the politics of knowledge

Climate science itself continues to advance rapidly. The Bloomberg Green newsletter titled “Five Takeaways From the World’s Biggest Earth Science Meeting” highlights how researchers at the American Geophysical Union meeting showcased new applications of artificial intelligence and machine learning to improve regional climate projections, flood‑risk modeling and decision‑support tools for emergency management. Examples include the use of large‑language models to simulate policy responses to catastrophic floods and efforts to translate complex hydrological models into “conversations on your iPhone,” making climate risk information far more accessible to households and communities.

At the same time, there has been intense political scrutiny of climate‑science institutions. In the United States, the proposed dismantling of the National Center for Atmospheric Research (NCAR) was described by leading scientists as “scientific vandalism,” underlining the degree to which climate research is now entangled with broader cultural and political debates. Yet the broader trend remains one of increasing use of scientific data in policy and market decisions: national meteorological and hydrological services providing climate services have nearly doubled since 2015, and the share offering essential to advanced services is expected to exceed 90 percent by 2027, assuming sustained support.

Technology: deployment at scale

The cost curve for key decarbonisation technologies continued to bend in 2025, even as supply chains and trade policy created pockets of stress. The attached material notes that renewable power costs keep falling, and in some regions electricity systems are approaching a de facto “endgame” of decarbonisation: roughly three‑quarters of power generation in the United Kingdom and Europe now comes from non‑fossil sources, similar to long‑clean grids in Brazil and Canada.

Electric vehicles (EVs) have moved decisively into the mainstream. Plug‑in vehicles now account for more than half of all new car sales in China and just under one‑third in Europe, with market shares above 20 percent in emerging markets such as Turkey, Thailand and Vietnam. BloombergNEF data suggest that Europe is likely to reach around 3.9–4.0 million plug‑in sales in 2025, significantly above expectations of 3.2 million made a year earlier. This shift is increasingly global rather than limited to wealthy economies.

Clean‑energy investment has also reached record levels. The International Energy Agency’s World Energy Investment 2025 report estimates that global energy investment will reach approximately 3.3 trillion US dollars this year, with about 2.2 trillion directed to clean energy. BloombergNEF data indicate that renewable‑energy investment reached a record 386 billion US dollars in the first half of 2025 alone, up 10 percent year‑on‑year. While these figures fall short of the 7–8 trillion dollars per year that may be required by 2030 for a 1.5°C‑aligned pathway, they signal a structural redirection of capital toward electrified and low‑carbon systems.

Infrastructure, grids and system stress

One of the less discussed but increasingly central themes of 2025 is the stress on electricity grids. As the attached analyses note, rapid growth in data centres, electrification of transport and heating, and the scale‑up of renewables have caused grid stress to rise in almost all G20 countries. Bloomberg Economics links higher grid stress to lower capital investment, suggesting that electricity reliability is emerging as a binding macroeconomic constraint rather than a narrow engineering problem.

Examples from Europe illustrate the challenge. The Netherlands is already consuming as much electricity as had been forecast for 2030, leading grid operators to warn that “the physical grid cannot keep pace with societal ambitions and developments” without fundamental changes to how systems are planned and managed. At the same time, there are positive signals: non-fossil energy is nearing approaching 80 percent in parts of Europe and the UK and attention is shifting to flexible technologies, storage, demand response and market design—areas where policy clarity and regulatory innovation are likely to be as important as hardware.

Emerging markets, adaptation and early warning

WMO and United Nations data underline that adaptation remains under‑financed relative to mitigation, even though the human and economic impacts of climate change are most acute in vulnerable developing countries. The World Economic Forum and partners estimate that emerging markets and developing economies will need on the order of 2.4 trillion US dollars per year in climate investment by 2030, including roughly 1 trillion in external finance, much of it private.

Nevertheless, 2025 has seen meaningful progress in resilience. WMO reports that the number of countries with multi‑hazard early warning systems has more than doubled since 2015, from 56 to 119, although 40 percent of countries still lack such systems. This progress is most notable among least developed countries and small island developing states, where coverage has increased by about five percentage points in the past year alone. These developments complement grassroots and local initiatives such as those highlighted in the New York Times’ “50 States, 50 Fixes” series, which documents community‑scale solutions ranging from innovative geothermal projects to “repair cafés” and “libraries of things” that promote circularity.

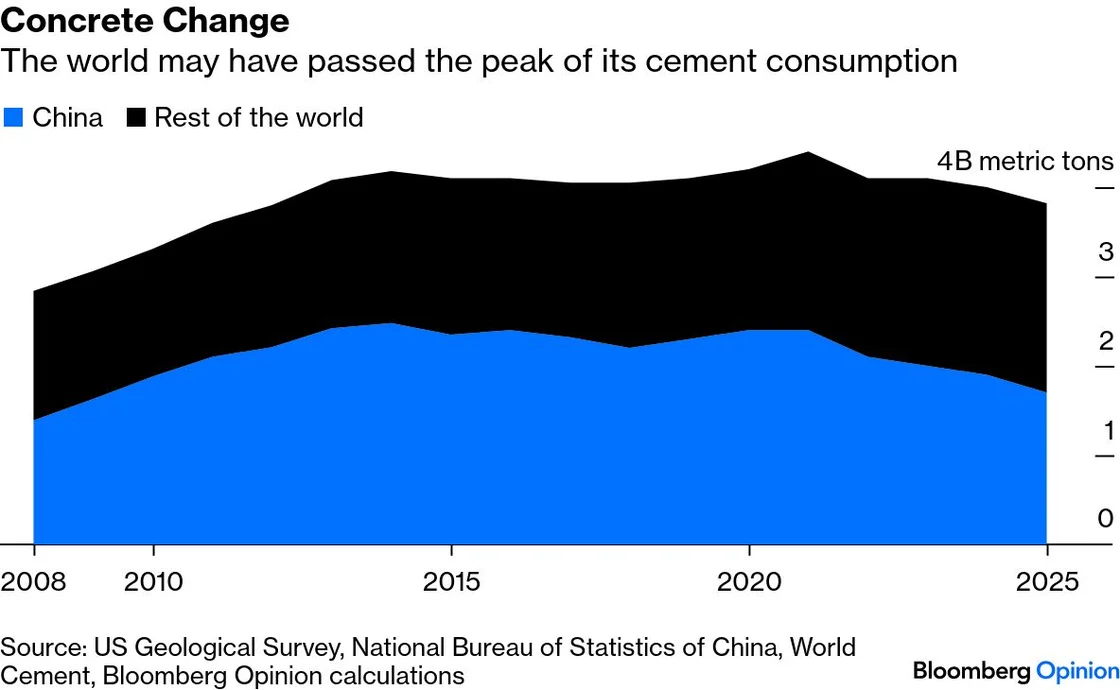

Real‑economy transitions: industry and materials

Beyond power and transport, 2025 has brought important signals in heavy industry and materials. According to Bloomberg, evidence that the world may have passed “peak cement,” with China’s cement output through October at its lowest since 2009 and global consumption on track for its lowest level since 2012. Since cement production accounts for up to 8 percent of global carbon dioxide emissions, even a plateau in demand opens space for technology shifts in low‑carbon cements and alternative building materials.

At the same time, large‑scale infrastructure continues to play a central role in climate and development strategies. One example is China’s new hydropower megaproject on the Yarlung Tsangpo river in Tibet, described as requiring “sixty times the cement of the Hoover Dam” and more steel than 116 Empire State Buildings. This project illustrates the dual nature of transition investments: they can support decarbonisation and growth but also entail geopolitical, environmental and social trade‑offs that must be carefully managed.

Climate, macroeconomy and finance

International financial institutions increasingly frame climate as a macro‑critical issue and in the International Monetary Fund’s 2025 World Economic Outlook notes that global growth is projected to slow modestly from 3.3 percent in 2024 to 3.2 percent in 2025 and 3.1 percent in 2026, with climate‑related shocks and energy‑transition policies among the factors shaping country‑level trajectories. The IMF’s broader work on climate and the economy emphasises that well‑designed carbon pricing, green public investment and targeted support for vulnerable households can support growth while reducing emissions and fiscal risks.

The World Economic Forum’s recent analysis on mobilising private capital for climate action argues that emerging markets will require structural reforms, project‑preparation pipelines and risk‑sharing mechanisms to attract the required scale of private finance. It highlights tools such as blended finance, climate innovation funds and syndicated structures with multilateral development banks to turn climate ambition into bankable projects. Climate Policy Initiative’s 2025 “Global Landscape of Climate Finance” further underlines the need to expand both mitigation and adaptation finance flows and to improve the quality, not just the quantity, of capital.

Looking ahead

Looking into 2026 and beyond, three themes appear particularly important for long‑term, fundamentals‑driven investors across asset classes:

- Resilience as a core economic variable. Physical climate risk—heat, floods, storms and water stress—is now integral to sovereign risk, corporate earnings and infrastructure reliability, rather than a distant scenario.

- System‑level infrastructure and policy. Grid capacity, permitting, market design and international climate‑finance frameworks such as those emerging from COP30 will be as important as individual technologies in shaping the speed and distribution of the transition.

- Innovation and diffusion. Advances in artificial intelligence, materials science and climate analytics are diffusing quickly from laboratories into operational practice, reshaping how governments, companies and communities understand and manage climate risk.

Asia Green Fund Management will continue to follow these developments closely. On behalf of the entire team, thank you again for your confidence and partnership, and warmest wishes for a safe, healthy and fulfilling 2026.

Redefining the Future of Sustainable Investment & Family Dynamics

Asia Green Fund Management is licensed by the Monetary Authority of Singapore as Capital Markets Services (CMS) provider based in Singapore, dedicated to advancing Asia’s sustainable future through high-integrity green investments. Our services span Family Office Advisory, Private Equity & Venture Capital and Private Credit, with a focus on green technologies and infrastructure. We invest in scalable solutions that drive environmental and social impact across the region.

Asia Green Fund Management Pte. Ltd., 168 Robinson Road, Capital Tower, #19-15, Singapore 068912

References:

World Meteorological Organisation, “2025 set to be second or third warmest year on record, continuing exceptionally high warming trend,” State of the Global Climate Update 2025. https://wmo.int/news/media-centre/2025-set-be-second-or-third-warmest-year-record-continuing-exceptionally-high-warming-trend

Bloomberg Green, “The Positive Climate News You May Have Missed This Year – Takeaways,” 2025. https://www.bloomberg.com/opinion/articles/2025-12-23/the-positive-climate-news-you-may-have-missed-this-year

World Economic Forum, “Fostering Effective Energy Transition 2025.” https://www.weforum.org/publications/fostering-effective-energy-transition-2025/

International Monetary Fund, World Economic Outlook, October 2025. https://www.imf.org/en/publications/weo/issues/2025/10/14/world-economic-outlook-october-2025

United Nations / UN News, “Belém COP30 delivers climate finance boost and a pledge to plan fossil fuel transition,” November 2025. https://news.un.org/en/story/2025/11/1166433

International Energy Agency, World Energy Investment 2025; BloombergNEF, Renewable‑energy investment data, mid‑2025 update. https://www.iea.org/reports/world-energy-investment-2025

International Monetary Fund, “Climate and the Economy,” Climate Change Policy Hub. https://www.imf.org/en/topics/climate-change/climate-and-the-economy

Climate Policy Initiative, “Global Landscape of Climate Finance 2025 – Methodology and Key Findings.” https://www.climatepolicyinitiative.org/wp-content/uploads/2025/06/Global-Landscape-of-Climate-Finance-2025-Methodology.pdf

Bloomberg Green, “The Climate Stories Bloomberg Green Most Admired This Year – Best of Green,” including analysis of grid stress and Xi’s hydropower ambitions https://www.bloomberg.com/news/newsletters/2025-12-27/the-climate-stories-bloomberg-green-most-admired-this-year

World Economic Forum, “From Risk to Reward: Unlocking Private Capital for Climate and Growth,” November 2025. https://reports.weforum.org/docs/WEF_Risk_to_Reward_2025.pdf

Bloomberg Green, “Five Takeaways From the World’s Biggest Earth Science Meeting,” December 2025. https://www.bloomberg.com/news/newsletters/2025-12-19/five-takeaways-from-the-world-s-biggest-earth-science-meeting

The New York Times, “50 States, 50 Fixes,” 2025. https://www.nytimes.com/interactive/2025/climate/50-states-fixes.html

BloombergNEF, “Global Renewable Energy Investment Still Reaches New Record as Investors Reassess Risks,” August 2025. https://about.bnef.com/insights/clean-energy/global-renewable-energy-investment-reaches-new-record-as-investors-reassess-risks/

Disclaimer: This presentation has not been reviewed by the Monetary Authority of Singapore. This presentation and any references to any capital market products and/or services thereof are for informational purposes only. Nothing shall be construed or deemed an offer or sale of capital market products or services. The target audience for this presentation are accredited, institutional investors or expert/professional investors (as the case may be) only. Any data displayed or referenced are forward-looking in nature and they shall not be regarded as guarantees of actual performance or results. Capital market products and/or services permitted in Singapore may be subjected to selling restrictions imposed by other jurisdictions. You are encouraged to seek independent professional advice should you have any questions.